capital gains tax indonesia

There is a non-taxable amount which varies per region and the non-taxable amount is IDR80 million US5504 in Jakarta. In contrast the new Article 13 of the Singapore-Indonesia DTA will allocate to the investors country of residence taxing rights on capital gains from the sale of assets and shares in Indonesian private companies other than that from the sale of immovable properties or shares of private companies deriving more than 50 per cent of their.

Memahami Konsep Capital Gains Sebagai Penghasilan

In arriving at effective capital gains tax rates the.

. Companies listed on the Indonesia Stock Exchange IDX that offer at least 40 percent of their total share capital to the public obtain a 5 percent tax cut hence a tax rate of 20 percent applies for these public companies. A in the case of indonesia. Or - stay in Indonesia for more than 183 days in any 12-month period.

Residency tests are applied as follows. Income tax at normal rates is due on any capital gain made on the disposal of shares. Share deal Capital gains received by an entity in a share deal are subject to corporate income tax of 25 while capital gains received by an individual are subject to individual income tax in the range of 5 until 30.

The settlement and reporting of the tax due is done on self-assessed basis. Capital gains derived by an individual are taxed as ordinary income at the normal rates. This is the final tax of the transaction value.

Taxation on Capital Gains and Investment Income Capital gains are generally assessable at standard income tax rates together with other income of the individual. However there are several exemptions. The New Treaty will replace the existing tax treaty that has been in effect since 1992 Current Treaty and will take effect for most purposes on 1January 2022.

However there are several exemptions. 44PMK032020 MOF Regulation 44 may now enjoy those tax incentives under Minister of Finance Regulation No. Capital gains tax rates on most assets held for a.

There is an additional tax of 05 for founder shares sold through the stock exchange. Or 15 upon election and the gains are as a result of the realisation of investment assets. However if the shares are sold through the stock exchange the stock exchange withholds an additional 01 of final income tax Government Regulation No.

The calculations for gains taxes would defer based on the category being taxed. On the transfer of assets other than land and buildings 25 capital gain tax due on net basis will apply for the Indonesian tax resident seller. Currently the Indonesian withholding tax of five percent is payable on the gross proceeds from a sale of shares in a private Indonesian company irrespective of the composition of its asset base and regardless of whether there is an actual gain made from the sale.

An additional tax of 05 applies to the share value of founder shares at the time of an initial public offering. Gains on listed shares are taxed at 01. Indonesia considers capital gains tax on cryptocurrency trades.

If the seller is non-Indonesian tax resident the 5 capital gain tax final due on gross basis will. Some taxpayers that were not entitled to tax incentives under Minister of Finance Regulation No. Gains on disposal buildings or land are taxed at 25.

An additional tax of 05 applies to the share value of founder shares at the time of an initial public offering. Gains on the disposal of land andor. 5 rows If youre a tax non-resident20 based on gross income.

With the impending change the taxing right will henceforth be with Singapore. In general a corporate income tax rate of 25 percent applies in Indonesia. 152 rows Capital gains are included as part of income and taxed at the individuals marginalgraduated tax rate for residents and 25 for non-residents.

Or - are present in Indonesia during a tax year and intending to reside in Indonesia. The capital gains tax in indonesia is the taxes that taxed at normal rates on the ordinary income that is derived by an individual. This is the final tax of the transaction value.

The tax base is the transfer value of the property. Since the assessee claimed depreciation on the rig in the past it was an asset of the pe. Other income-related tax rates to keep.

Capital gains are generally assessable together with ordinary income and subject to tax at the standard CIT rate. Taxation in Indonesia is determined on the basis of residency. The New Treaty was ratified by Indonesia on 11 May 2021 and entered into force on 23 July 2021 after ratification by Singapore.

Under the new DTA the investors country of residence will be allocated the taxing rights on the capital gains from the sales of shares and assets of Indonesian companies. It is important to know that if there is a profit or capital gain generated from a transaction the profit is an object of income tax the official stated. Or 15 upon election and the gains are as a.

Reduction of the withholding tax rates for royalties. For the transfer of unlisted shares 25 capital gain tax due on net basis will apply for the indonesian tax resident seller. Di tahun 2015 capital gain jangka panjang dikenakan pajak yang bermacam-macam mulai dari 0 untuk pajak penghasilan 10 dan 15 15 untuk pajak penghasilan 25 sampai 35 atau 20 untuk 396 pajak penghasilan.

How Capital Gains Taxes in Indonesia Are Calculated. This is the final tax of the transaction value. - are domiciled in Indonesia.

The gains taxes are taxed at different percentages. Sale of land andor buildings located in Indonesia. The previous DTA did not regulate capital gains.

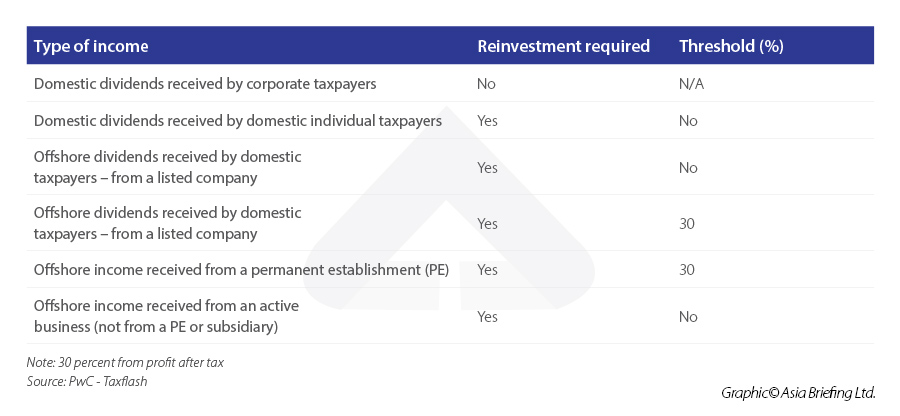

Individual resident taxpayers are individuals who. The Indonesian government has expanded the tax incentives given to taxpayers that are affected by COVID-19. Based on worldwide income taxation concept overseas investment income and capital gains are treated as normal income subject to income tax.

86PMK032020 MOF. However sale of locally listed shares are subject to a final tax at 01 percent of gross sales proceeds and sale of domestic real estate is subject to 25 percent final income tax on the sale price. However gains from the transfer of land and buildings are not subject to regular CIT but rather are subject to final income tax at a rate of 25 of the transaction value or the government-determined value whichever is higher.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. Gains on shares listed in Indonesia are taxed at 01 final tax of the transaction value. Capital gains taxes.

CAPITAL GAINS Land and Building Transfer Duty The land and building transfer duty is levied at a flat rate of 5 and is charged to the seller. Indonesia plans to charge value-added tax VAT on crypto asset transactions and an income tax on capital gains from such investments at 01 each starting from May 1 a tax official said on. Selain Capital Gain Anda Juga Bisa Mengalami Capital Loss Investasi tidak selalu untung terkadang Anda juga bisa merugi.

In Indonesia the main differences among acquisitions made through a share deal versus an asset deal are as follows. Neilmaldrin Noor a spokesperson for the Indonesian Directorate General of Taxes said that the authority is considering a tax scheme for capital gains generated from cryptocurrency trades Reuters reported on Tuesday.

New From Us Kelaspelatihan Keuangan

Capital Gain Adalah Dan Pajak Capital Gain Saham

Latihan Contoh Soal Skb Bidang Hukum Cpns 2019

Dividen Bebas Pungutan Pajak Begini Cara Dan Syaratnya The Indonesia Capital Market Institute Ticmi

Pmk 111 Pmk 03 2014 In 2021 Kartu Keuangan Orang

Teruslah Konsisten Dalam Melakukan Pekerjaan Anda Trading Forex Trader Stocks Stockmarket Forexsignals Pips F In 2021 Risk Management Business Funding Trading

Djp Online Adalah Cara Termudah Dan Paling Pantas Bagi Wajib Pajak Untuk Membayar Pajak Tepat Waktu Tanpa Perlu Rep Capital Gains Tax Income Tax Tax Deductions

Binance Faces Deal For New Crypto Exchange In Indonesia Rich Family Crypto Market Indonesia

Indonesia Mulls Taxing Cryptocurrency Trades Cryptocurrency Indonesia Mulled

What Are The Changes In Tax Treatment Under Indonesia S Omnibus Law

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Di 2021 Pajak Penghasilan Jenis

Indonesia Considers Capital Gains Tax On Cryptocurrency Trades Capital Gains Tax Tax Questions Tax Rules

Peraturan Pemerintah No 60 Tahun 2008 Pdf Rumah Sakit Perbaikan Laporan Keuangan

Indonesia Singapura Perbarui Perjanjian Penghindaran Pajak Berganda P3b

Financial Crisis In Indonesia Problem Solutions And Lessons Financial Lesson Solutions

11 Likes 1 Comments Lavonya Jones Coachlavonyajones On Instagram Welcome Indonesia To The Karatbars Family Karatbars Karatbars International Investing

Pin By Gadai Bpkb Mobil Cepat Indones On Gadai Bpkb Mobil Cepat Indonesia Bunga Rendah Budgeting Debt Consolidation Loans Money Savvy